Market Update

As of August 27, 2021 – The following market update was provided by Bridgecape Commodities, with additional comments from the Pivotal team below.

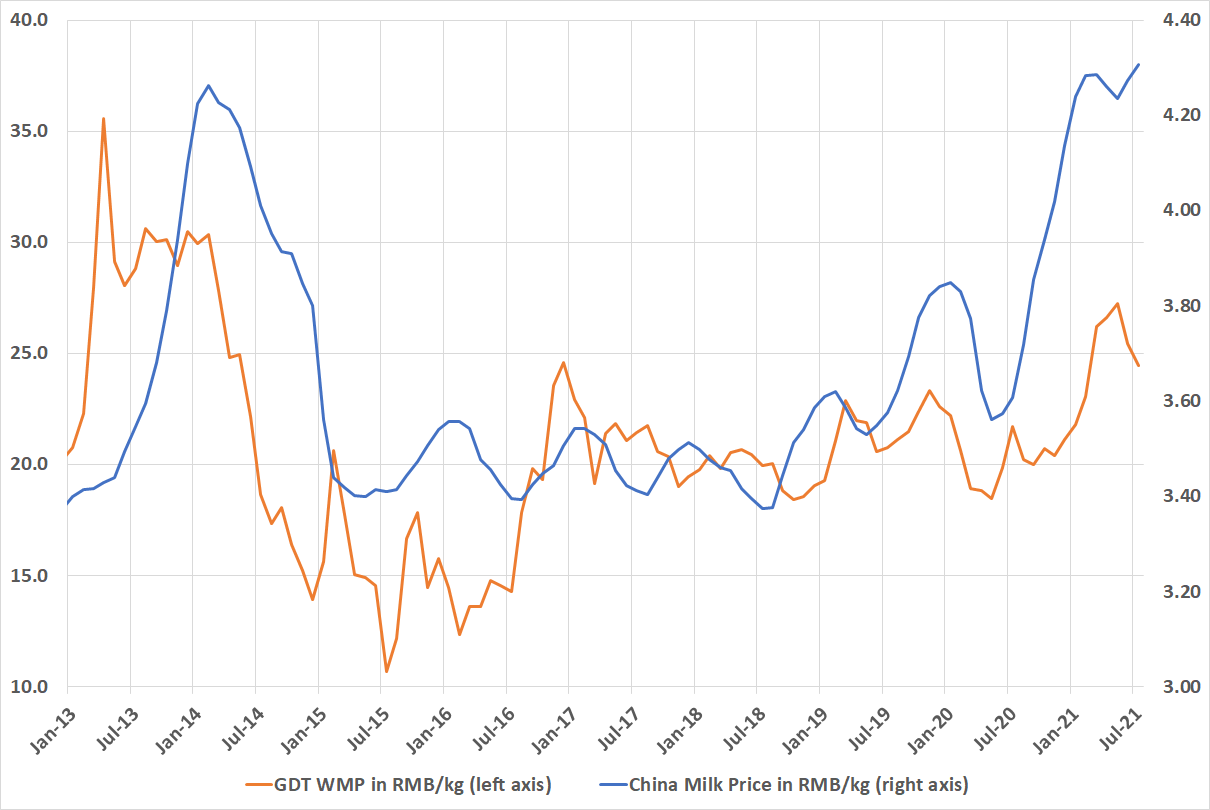

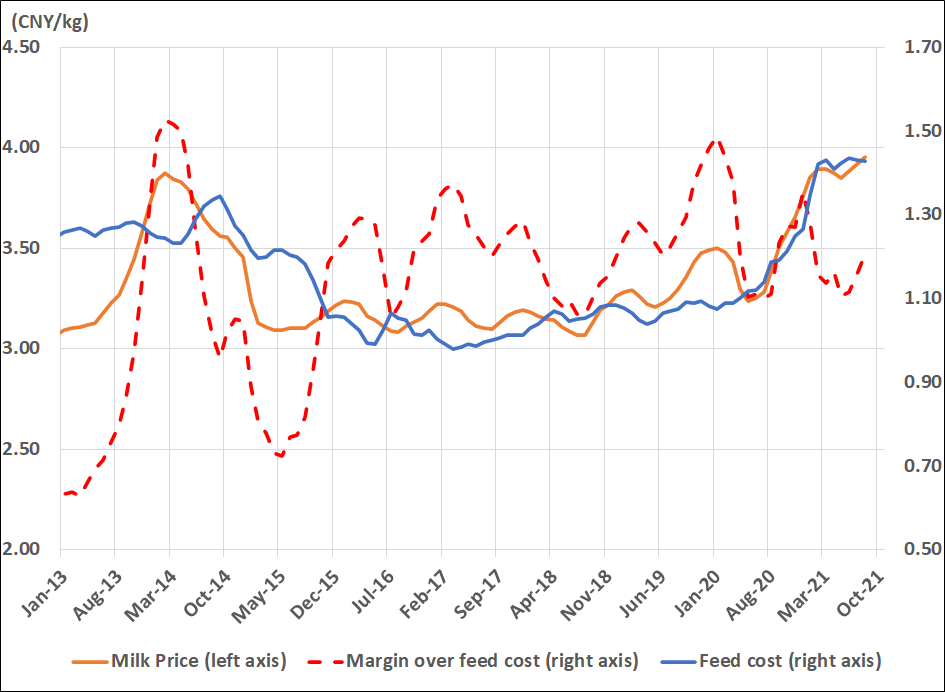

Chinese milk prices continue to rally recently and continue historically high relative to whole milk powder prices, especially after recent WMP declines. While milk prices would typically be expected to mean more local milk production, they have really only kept up with local feed prices, meaning margins for milk producers remain lower than historical. This should mean the ongoing need for WMP and other imports into the first half of 2022.

Additional Market Comments from Jeff Goodwin

Logistics continues to impact feed cost in China.

Infant formula sales pressure reflected in the domestic Lactoferrin price which is now selling in a range of 4500-6000rmb per kg

物流继续影响中国的饲料成本。

婴幼儿配方奶粉销售压力反映在国内乳铁蛋白的价格,目前价格在4500-6000元/公斤之间